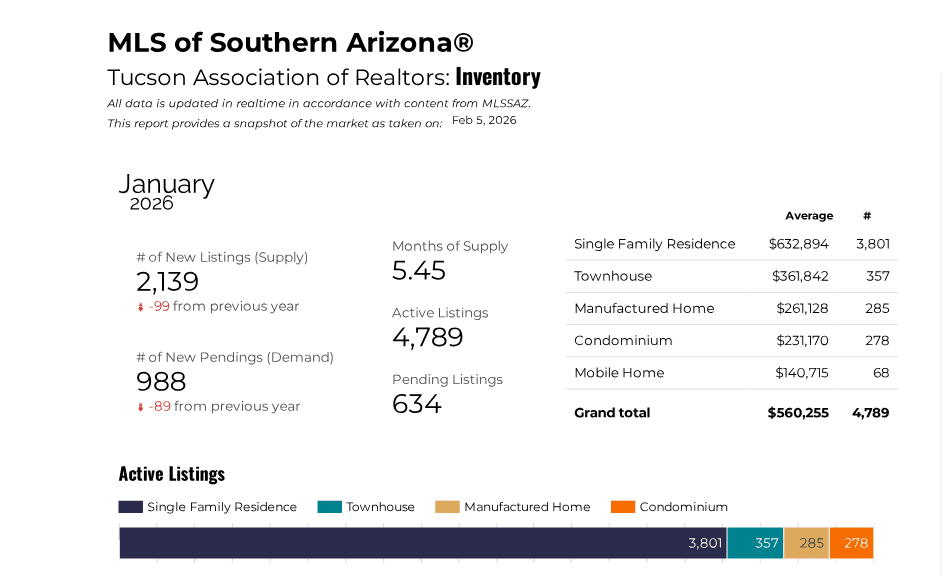

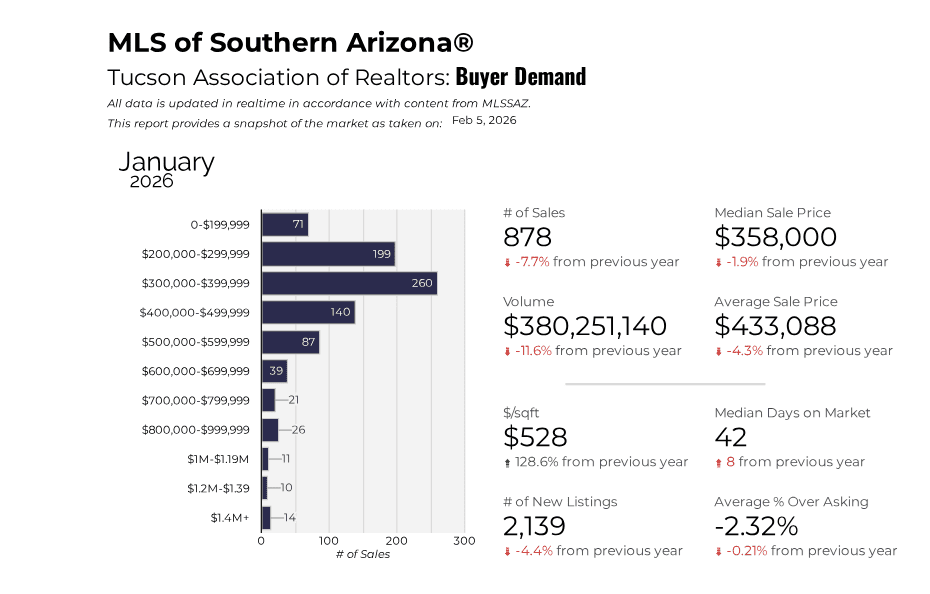

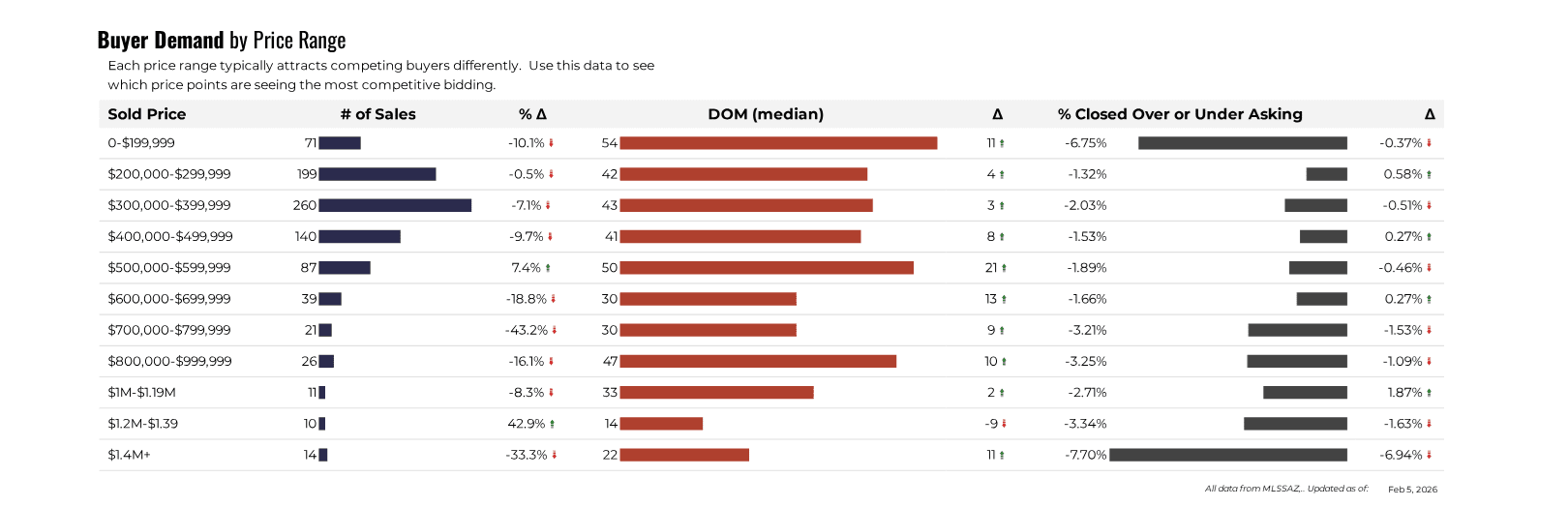

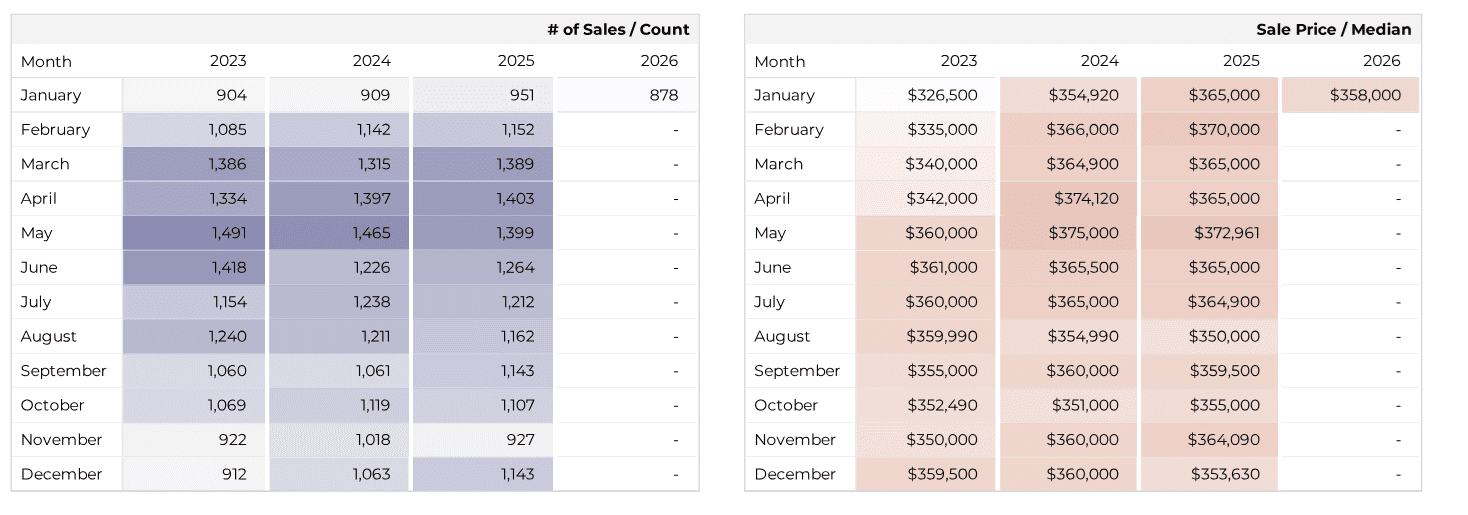

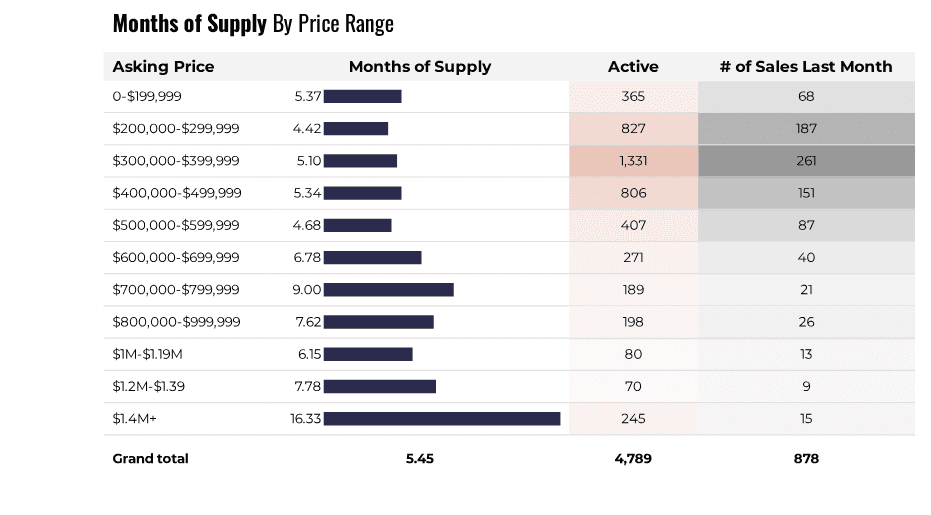

| Tucson home values for January 2026 saw the median sales price at $358,000, down 1.9% YoY. The average sales price for the month was $433,088, down 4.3% YoY. Although home prices declined in January, experts suggest the overall Tucson market remains stable heading into 2026. Tucson’s major suburban markets Oro Valley – Catalina Foothills – Dove Mountain – Marana – will have different median price levels. Contact a local Realtor team – Ben & Kim Boldt for more information. |

Tucson Home Values – January 2026

Median home values in popular Tucson suburban areas vary significantly.

| Area | Median Value Range |

| Oro Valley | $500,000 to $535,000 |

| Catalina Foothills | $630,000 to $745,000 |

| Dove Mountain | $560,000 to $1,000,000+ |

| Green Valley | $275,000 to $325,000 |

Tucson Housing Market Overview & Home Prices vs Florida and Texas

Tucson homes are generally less expensive than Florida. This is especially true in coastal or high?demand metro areas. Also, Tucson remains more affordable with lower insurance and lower climate?risk costs.

Florida’s statewide median is roughly $375,000. Coastal cities (Miami, Naples, Tampa) are far above Tucson falling in the $450,000 to $700,000 range. Inland markets (Ocala, Lakeland) are closer but still generally higher.

Texas median home values vary by metro area. Metro areas such as Dallas and Austin are higher with home prices in the $400,000 to $550,000 range. On balance, most large Texas cities sit above Tucson. This makes Tucson one of the more affordable Sun Belt markets.

Now the Tucson Home Value Details

Considering A Home Tucson – Start Your Tucson Home Search Now

Considering A Home Tucson – Start Your Tucson Home Search Now

Search ALL Neighborhoods to See Homes for Sale in Tucson AZ

Finding the right home can be a challenging process, but we can make the process much less stressful for you. As top Tucson Realtors since 2002, we know Tucson and the Tucson Real Estate market. We take the time to understand your home buying interests and desires to ensure we help you find the “right” home.

At our first meeting, we will review the current real estate market with you and then walk you through the Arizona home buying process.

Why? We want you to know what to expect. And what to plan for.

Summary

Tucson, Arizona

Tucson remains one of the more affordable major markets in the Southwest.

>> Typical home value: ~$358,000

>> Market trend: Lower prices year over year softening, but stabile

>> Takeaway: Strong value relative to other warm weather destinations

Florida

Florida home prices remain higher than Tucson despite recent cooling.

>> Statewide median value: ~$375,000

>> Market trend: Price corrections in many metros, especially coastal area

>> Takeaway: Florida is still more expensive than Tucson, especially in coastal and resort markets

Texas

Texas shows wide variation by metro, but most large cities sit above Tucson.

>> Major metro values: Generally higher than Tucson

>> Smaller markets: Often similar or slightly below Tucson

>> Market trend: Inventory increases have softened prices, but affordability varies dramatically

>> Takeaway: Texas is mixed, but its biggest cities remain pricier than Tucson

|

|

|

|

Conclusion

What all this means to Buyers is –

>> Tucson is more affordable than Florida and most of Texas’s large metros.

>> Florida is the most expensive of the three, even after recent price declines.

>> Texas varies widely, but its big cities generally exceed Tucson’s price point.

Thank you for visiting www.premiertucsonhomes.com! It’s one of the top real estate websites in Tucson.

Our website provides information on communities and neighborhoods in the greater Tucson area. Want more? Give us a call – 520-940-4541.

Take a few minutes to read our profiles and client testimonials.

Are we the Tucson Realtors you have been looking for?

Sign UP to receive daily HOME TRACKER UPDATES - OR - Our Monthly NEWSLETTER. And get regular updates on the Real Estate Market and events in Tucson, AZ.

Questions about the Tucson Real Estate Market or Tucson Homes for Sale? Call Us - 520 940 4541 OR complete the - CONTACT FORM - and we will get right back to you!

Go to the Tucson Housing Market Pulse archives for a see past housing reports and trends.

Sign UP to receive daily HOME TRACKER UPDATES - OR - Our Monthly NEWSLETTER. And get regular updates on the Real Estate Market and events in Tucson, AZ.

Questions about the Tucson Real Estate Market or Tucson Homes for Sale? Call Us - 520 940 4541 OR complete the - CONTACT FORM - and we will get right back to you!

data mortgage rent

az housing market

days on market

pima county

zillow houses for rent median home prices family homes atlanta houses rentals september atlanta apartments phoenix houses houston houses portland houses zip codes arizona mortgage rates austin houses nashville houses real estate agents new mexico mortgage rates